Tariff engineering is the legitimate practice of designing a product, its components, or its classification to ensure that, upon import, it qualifies for a lower tariff rate. This is not tariff evasion—it is a deliberate, commercially sound, and technically defensible strategy supported by thorough documentation and expert customs guidance.

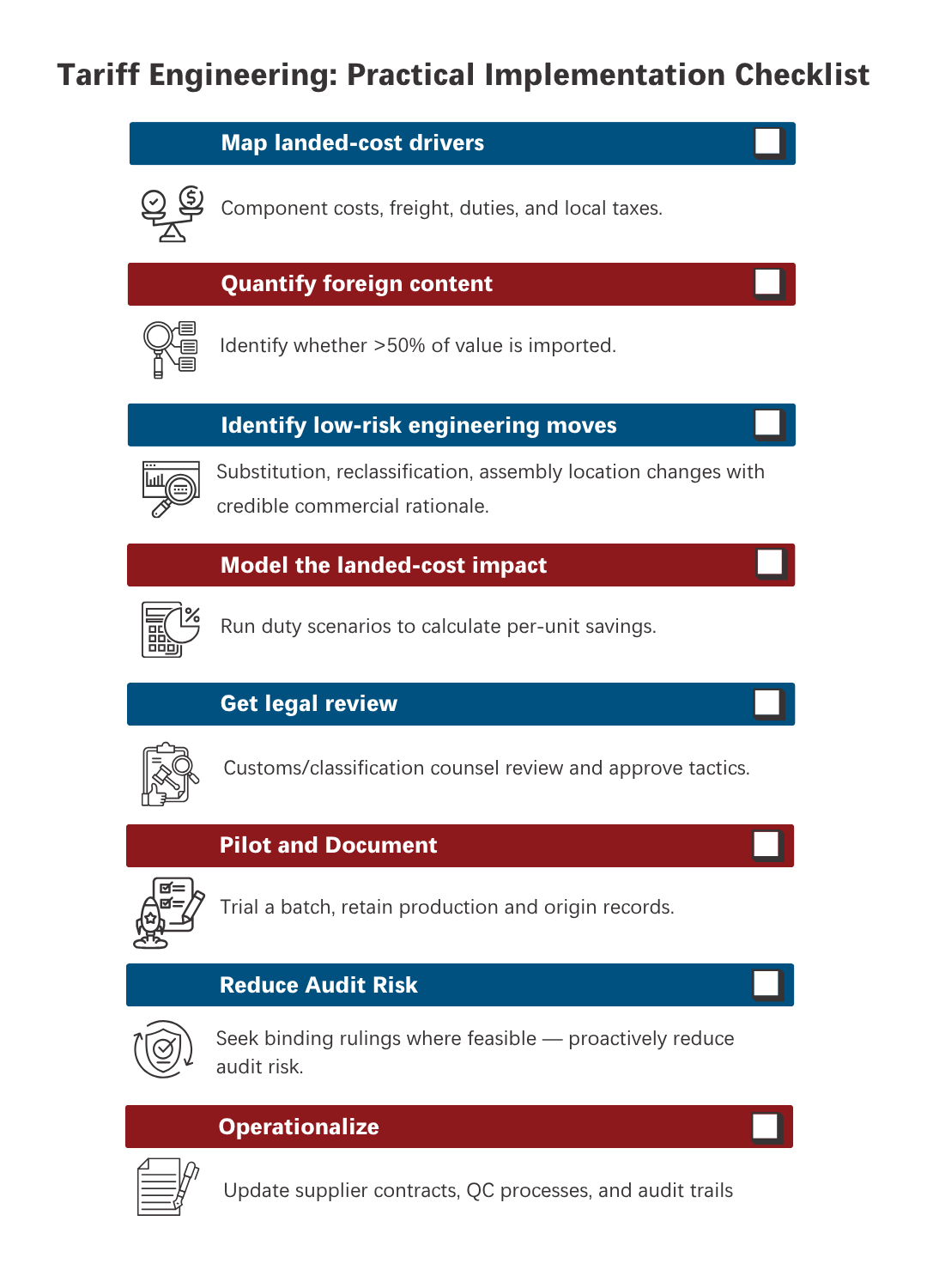

Practical Strategies

- Material Substitution: Use clinically acceptable raw materials, alloys, or electronic components that fall under lower-duty categories.

- Optimize Manufacturing Location: Shift the final substantial transformation or assembly to a country with favorable duty rates (e.g., final assembly in Mexico).

- Reclassify Where Justified: Import as parts or subassemblies rather than finished devices when classification rules allow.

- Design for Classification: Adjust dimensions, packaging, or assembly to align with HS codes that attract lower tariffs.

- Mitigate Risk: Secure binding rulings and maintain clear origin documentation to reduce audit exposure.

Why It Matters

A single HS code adjustment or a strategic shift in where value is added can significantly reduce duties and improve per-unit economics—often at a fraction of the cost of building new facilities.

Compliance Considerations

Tariff engineering must be grounded in commercial substance and supported by robust documentation. Non-compliance risks include retroactive duties, penalties, and prolonged legal disputes. Always pair engineering decisions with customs counsel and maintain comprehensive process records.