In today’s high-stakes MedTech landscape, your supplier network directly reflects your product integrity, regulatory posture, and time-to-market reliability.

For manufacturers of Class II and III devices, supplier non-conformance can trigger far more than a CAPA. It can mean product recalls, audit failures, or even compromised patient safety. Regulators have responded accordingly: ISO 13485:2016, FDA QSR, and EU MDR now expect robust, risk-based supplier management as a core function of your quality system, not a reactive one.

Despite this, many MedTech companies still face fragmented supplier control systems. Gaps in qualification, weak change notification processes, and unclear quality expectations introduce hidden risks.

At Syrma Johari MedTech, we recognize that building a resilient and compliant supply chain is a key differentiator. With 45+ years of manufacturing experience and an ISO 13485:2016-certified, MDSAP-compliant QMS, our organization has made supplier control a central pillar of our operations. The following best practices reflect our commitment to delivering high-quality, safe devices through strong supplier partnerships:

Aligning Supplier Assessment with Global Regulatory Requirements

Global regulators place increasing responsibility on OEMs to evaluate and monitor their suppliers. ISO 13485:2016 Clause 7.4 mandates documented procedures for the evaluation, selection, monitoring, and re-evaluation of suppliers, scaled to the product’s impact on device safety and performance.

Notably, ISO 13485:2016 emphasizes a risk-based approach – “the type and extent of control applied to the supplier… shall be dependent upon the effect of the purchased product on the quality of the medical device” [1][2]. It demands that supplier capability assessment be risk-based and traceable to product quality.

In the U.S., 21 CFR 820.50 (Purchasing Controls) mirrors these principles. The FDA QSR requires manufacturers to “ensure that all purchased or otherwise received product and services conform to specified requirements” [3]. Specifically, each manufacturer must establish and maintain requirements for suppliers, including quality criteria, and evaluate and select suppliers based on their ability to meet those requirements (with records of these evaluations). Furthermore, manufacturers must define the type and extent of control to exercise over each supplier, commensurate with the supplier’s performance and the product’s impact, and maintain an approved supplier list (ASL) or equivalent. Purchasing documentation should specify all quality requirements and, where possible, include agreements that suppliers will notify the manufacturer of any changes to the product or process. In practice, this means robust procedures for supplier qualification, quality agreements, and change control are not just best practices; they are legal mandates under FDA rules.

Crucially, “compliance” in this context goes beyond having paperwork on file. It requires system maturity: risk-based supplier evaluation models, documented justifications for controls, and integration of supplier metrics into your broader QMS performance reviews.

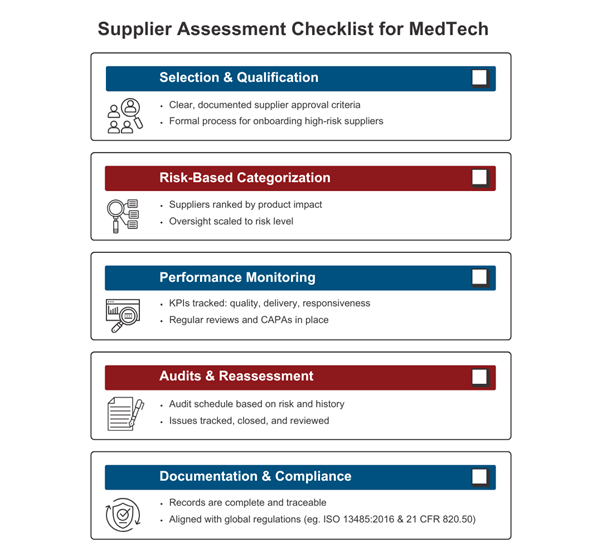

Three Pillars of Efficient Supplier Assessment for Medical Device Companies

Pillar 1: Strategic Supplier Selection and Appraisal

The foundation of strong supplier management is choosing the right suppliers up front. In the medical device arena, supplier selection must go far beyond finding the lowest cost bidder. Important criteria include:

- Capability and Technical Competence: Can the supplier consistently meet the technical specifications and tolerances required? Do they have the necessary equipment, process controls, and skilled personnel for the component or service in question? Capacity for scale-up is also a consideration.

- Quality Management System (QMS) maturity: Does the supplier have a robust quality system, ideally certified to standards like ISO 13485:2016 or ISO 9001? A supplier’s own QMS and regulatory certifications are strong indicators of their commitment to quality. For instance, if a candidate supplier is ISO 13485:2016-certified by a recognized registrar, an OEM might focus an on-site audit more on specific processes and capabilities rather than basic quality procedures. Conversely, using a supplier with no formal certification demands a heavier upfront evaluation.

- Regulatory and Compliance history: Especially for critical or regulated materials, check if the supplier has a record of compliance (e.g., FDA registration or any past warning letters/recalls). Manufacturers often perform due diligence via questionnaires or databases to ensure the supplier hasn’t had serious regulatory issues.

- Performance and Track Record: Assess the supplier’s reputation for quality and reliability. This can involve reviewing their defect rates or on-time delivery performance for other customers, and even requesting references. Similarly, transparency and responsiveness in communication are essential traits. If a supplier is slow to reply or evasive during the RFQ stage, that may foreshadow problems down the line.

- Financial and Operational Stability: Evaluate the supplier’s financial health, business continuity plans, and capacity. A financially unstable supplier or one operating at the edge of its capacity could pose supply risk.

Supplier evaluation should involve QA, engineering, procurement, and compliance teams to ensure alignment. Tools like structured supplier questionnaires, certification reviews, and risk-based audits help filter and validate potential partners.

At Syrma Johari MedTech, we maintain a diverse, strategically segmented supplier base of over 400 partners across geographies and categories, spanning critical component providers, raw material vendors, and process service suppliers. Each supplier is evaluated and assigned a risk classification based on its potential impact on product quality, regulatory exposure, and supply continuity.

Our qualification protocol aligns with ISO 13485:2016 and 21 CFR 820.50 and includes a staged, cross-functional assessment: initial screening through detailed capability questionnaires, QMS certification validation, and document audits, followed by risk-tiered on-site or virtual audits. For critical suppliers, additional verifications such as process validations, change notification mechanisms, and escalation protocols are integrated into contractual agreements.

During the COVID-19 crisis, this robust and agile framework allowed us to onboard alternate suppliers rapidly, using virtual audit tools, remote documentation reviews, and digital inspection workflows. These procedures preserved our compliance posture while mitigating disruption, reinforcing the strategic value of a digitized, risk-based supplier qualification system.

Pillar 2: Implementing a Risk-Based Supplier Evaluation Approach

Modern supplier oversight frameworks in the medical device industry are anchored in risk-based segmentation, a principle embedded in global regulations like ISO 13485:2016 and FDA 21 CFR 820.50. Both standards mandate that manufacturers evaluate suppliers not with a one-size-fits-all lens, but through stratified controls based on the supplier’s potential impact on product safety, efficacy, and regulatory exposure [2][3].

Suppliers are typically categorized as Critical, Major, or Minor:

- Critical suppliers directly influence product functionality, patient safety, or compliance and thus demand the most rigorous evaluation and control.

- Major suppliers provide components with a moderate influence or those backed by mitigations.

- Minor suppliers offer standardized or non-critical parts with minimal risk exposure.

A leading US-based OEM, for instance, integrates this model through a supplier quality framework that explicitly ties supplier risk levels to device clinical performance. Their controls range from audit frequency to executive review schedules, scaled by supplier classification [4]

Regulators emphasize this tiering. The FDA instructs that “the type and extent of control over suppliers shall be based on the supplier’s impact on finished device quality and its past performance”. Risk-based models ensure that high-risk suppliers receive proportionally intensive oversight, a principle also echoed in the MDSAP audit model and EU MDR expectations.

A robust risk evaluation approach typically includes:

- Risk classification logic – based on FMEA, impact analysis, and business continuity risk

- Audit cadence –g., annual audits for critical suppliers, biennial or triennial for others

- Incoming inspection protocol – 100% lot inspection for high-risk items vs. skip-lot or CoC-based release for low-risk components

- Performance metrics and thresholds – KPIs such as OTD (>95% for critical), PPM levels, SCAR responsiveness

- Dynamic reclassification mechanisms – Suppliers trending poorly (e.g., >300 PPM, unresolved CAPAs, delivery variance) may be escalated in classification, triggering intensified surveillance and corrective actions

These strategies reflect a shift from static approval to real-time, data-driven risk modeling. Tools such as supplier scorecards assess critical metrics including OTD, non-conformance rates, and responsiveness to CAPAs or SCARs. This continuous feedback loop ensures supplier oversight is proportional, adaptive, and aligned with changing risk profiles.

Leading OEMs also apply risk tiering to refine audit intensity, mandate change control protocols, and direct engineering or QA resources to high-priority partners. This approach strengthens audit preparedness, reduces compliance risk, and ensures that supplier quality supports overall device lifecycle control. [5] [6]

Pillar 3: Ongoing Performance Monitoring and Continuous Improvement

After a supplier is qualified and onboarded, performance monitoring must be continuous and deeply integrated into the quality system. Global regulations emphasize that supplier oversight should extend well beyond initial qualification. It requires real-time data capture, systematic analysis, and structured feedback loops to drive improvement and ensure sustained compliance

The most effective programs begin with defining clear, quantifiable Key Performance Indicators (KPIs) that reflect both operational and quality dimensions. Industry-standard metrics include:

- On-Time Delivery (OTD): Late shipments, especially from critical suppliers, can halt production or delay regulatory filings. A common benchmark is >95% OTD.

- Incoming Defect Rate: Tracked in Parts Per Million (PPM), this metric reflects the percentage of defective items detected upon receipt.

- CAPA/SCAR Trends: Frequency and resolution speed of Corrective and Preventive Actions (CAPAs) and Supplier Corrective Action Requests (SCARs).

Leading manufacturers integrate these KPIs into supplier scorecards, which aggregate performance across defined intervals (e.g., quarterly). Scorecards are essential for identifying trends and facilitating data-driven supplier discussions. These dashboards often weigh criteria based on supplier risk classification. For instance, a critical supplier may have delivery and defect metrics weighted more heavily than administrative accuracy.

Regular supplier business reviews are conducted quarterly or biannually, during which scorecard results are shared. This not only ensures transparency but also builds trust and enables collaborative improvement. As recommended by Oriel STAT Matrix, performance expectations and thresholds should be mutually agreed upon in advance, reducing friction and enabling constructive dialogue

Trigger thresholds are pre-defined: for example, an OTD below 90% or a sudden spike in NCRs may initiate a supplier SCAR, or even trigger a requalification audit. Requalification may include a full document re-review, updated process audit, or reassessment of risk classification.

Modern supply chains leverage digital tools for automated performance tracking. ERP and QMS systems aggregate supplier data across quality, procurement, and production functions, flagging anomalies and enabling real-time visibility. Some advanced organizations implement predictive analytics to identify declining supplier trends before they result in compliance breaches or delivery disruptions.

Continuous improvement, as prescribed in ISO 13485:2016, means supplier evaluation must be both proactive and corrective. Feedback loops, root cause analysis from CAPAs, and improvement plans should be integral to the ongoing relationship. Ultimately, organizations that excel in performance monitoring don’t just identify problems faster; they prevent them from occurring at scale.

Navigating Common Challenges and Practical Tips

Even with a solid framework, MedTech companies often encounter practical challenges in supplier assessment:

- Legacy Suppliers: Legacy vendors often present gaps in documentation or outdated quality systems, especially if engaged before the introduction of modern QMS standards. Best practices include supplementing gaps with deeper audits, targeted quality agreements outlining current expectations, and enhanced incoming inspections. A leading US-based OEM, for instance, uses requalification frameworks that require legacy suppliers to undergo periodic reassessment or update their procedures to remain compliant with evolving standards.

- Offshore Vendors: Geographic distance can create visibility and communication barriers. To mitigate this, top-performing OEMs establish regionally placed quality liaisons, use bilingual or translated SOPs to ensure procedural clarity, and implement contractual Service Level Agreements (SLAs) with clearly defined metrics for compliance, delivery, and CAPA timelines. Multinational firms often layer in timezone-adjusted communication protocols and cloud-based QMS access to ensure responsiveness and audit readiness across borders.

- Supplier Development: Rather than terminating underperformers, many leading manufacturers pursue co-development initiatives. This may involve sponsoring third-party audits, facilitating gap assessments, or supporting suppliers in achieving ISO 13485:2016 certification. These strategies convert compliance risks into long-term quality assets and reduce sourcing volatility in tight supplier markets.

Smart Supplier Assessment as a Strategic Differentiator

Supplier control is a core driver for operational speed, quality, and compliance. Effective supplier assessment reduces rework, accelerates approvals, and strengthens your QMS for scale. It also lowers audit risk, improves product reliability, and reinforces credibility with regulators and customers.

At Syrma Johari MedTech, supplier assessment is integrated across onboarding, risk tiering, KPI tracking, and performance reviews. As an ODM and EMS partner, we also support OEMs in qualifying and developing suppliers during tech transfers and scale-ups.

Our QMS meets global standards across FDA, MDR, and MDSAP audits. Backed by decades of experience, we deliver the discipline and insight needed to build a resilient, compliant supply chain.

Looking for a partner who understands supplier compliance and executes it with discipline?

References

- Devine, C. (2023, July 11). Devine Guidance for an Effective Supplier Selection Process. MedTech Intelligence. https://medtechintelligence.com/column/devine-guidance-for-an-effective-supplier-selection-process/

- International Organization for Standardization. (2016). ISO 13485:2016 – Medical devices – Quality management systems – Requirements for regulatory purposes. https://www.iso.org/standard/59752.html

- U.S. Food and Drug Administration. (2023). 21 CFR Part 820 – Quality System Regulation (QSR), Subpart E – Purchasing Controls, § 820.50. https://www.ecfr.gov/current/title-21/chapter-I/subchapter-H/part-820/subpart-E/section-820.50

- Stryker Corporation. (n.d.). Supplier Quality Guidebook [PDF]. https://www.stryker.com/content/dam/commercial/usa/procurement/gsnps/PRT-GSNPS-OTHD-1372150-EN_US.pdf

- Johnson & Johnson. (n.d.). Our Position on Quality and Compliance. https://www.jnj.com/policies-reports/our-position-on-quality-and-compliance

- Siemens Healthineers. (n.d.). Supplier Standards. https://www.siemens-healthineers.com/en-us/customer-services/supplier-standards