Medical devices are built on globally distributed value chains: for example, sensors from Japan, plastics from Mexico, electronics from Asia, final assembly in the U.S. or EU, and post-market service worldwide. For much of the last three decades, this ecosystem scaled under a simple operating assumption, low or zero tariffs on MedTech products, which supported specialization, cost efficiency, and rapid innovation uptake. This period of open trade enabled global integration: world trade in medical devices expanded seven-fold over 30 years, reaching ~$700 billion in 2022. By mid-2024, the U.S. alone imported $14.9 billion of medical equipment in six months. Even products labelled “Made in the USA” presently rely on 50–80% foreign-sourced components.

The long-standing assumption of tariff stability is now fraying. Pandemic shortages, geopolitical frictions, and new policies around “resilience” have moved trade back to the center of board agendas. Tariffs are now considered alongside reimbursement changes, MDR/FDA reforms, and capital allocation as critical market variables. The result is a more volatile landed-cost environment and a tighter link between trade policy and supply assurance.

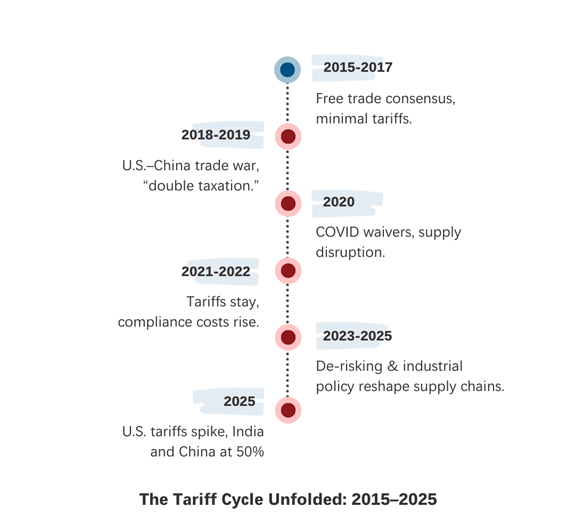

This article takes a long view of tariff history from 2015–2025, demonstrating how tariff waves have been cyclical across industries. For medical device companies, the lesson is practical: treat tariffs as recurring patterns that call for tariff-resilient business strategies to secure long-term wins.

The Tariff Cycle Unfolded: 2015–2025

2015–2017: A Stable Trade Era

In the mid-2010s, tariffs on medical devices were minimal. The average applied MFN tariff on medical products was only ~4.8%. WTO and WHO guidance explicitly endorsed zero tariffs on health products, and most high-income markets, including the U.S. and EU, complied. Rather than protectionism, U.S. policy debates centered on reimbursement reform and value-based care. The 2016 21st Century Cures Act and 2017 FDA Reauthorization Act streamlined review pathways and modernized user-fee programs.

Globally, China was rising as an exporter, supplying not just disposables like gloves and syringes but also high-tech systems such as CT scanners and MRI machines. Europe, meanwhile, focused on preparing its new Medical Device Regulation (MDR), applied in 2021, to harmonize clinical evidence, traceability, and post-market surveillance.

Consensus across regions was clear: open trade in medical devices supported patient access and innovation. The groundwork was set for an era of smooth integration; but it was short-lived.

2018–2019: The First Trade Disruption

The U.S.–China trade war marked the first disruption. In 2018–19, the Trump administration imposed successive 25% tariffs on ~$250 billion of Chinese imports, including diagnostic reagents, imaging components, and surgical supplies. China retaliated with 25% tariffs on U.S. exports, hitting imaging systems and reagents.

For the MedTech industry, the impact was immediate: cross-Pacific supply chains faced “double taxation”. Components moving between the two economies were taxed on both ends, inflating costs. Associations like AdvaMed petitioned for relief, arguing that tariffs on life-saving medical products would shrink rather than expand U.S. exports. Only limited exemptions were granted.

The trade war accelerated the “China+1” strategy. Companies began shifting assembly and sourcing to Southeast Asia (Vietnam, Thailand, Malaysia) to hedge against tariff volatility. This diversification trend would prove crucial in the years ahead.

2020: COVID-19 and Emergency Waivers

The pandemic exposed the fragility of global supply chains. Demand for masks, gloves, gowns, ventilators, and diagnostics surged beyond capacity. Imports stalled due to export bans and shipping bottlenecks.

To ease shortages, the U.S. temporarily lifted tariffs on key medical products. Ventilators, N95 masks, and diagnostic kits were exempted from duties, allowing duty-free imports. Yet bottlenecks persisted, and hospitals often turned to “gray market” suppliers, some of which delivered substandard or counterfeit goods.

Analysts later concluded that pre-existing tariffs had weakened U.S. preparedness. By curbing imports from China in 2019–20, the U.S. had eroded stockpiles of PPE—a “self-inflicted wound”. COVID-19 made clear that tariffs on critical health supplies can backfire when demands surge.

2021–2022: Strategic Reassessment and Realignment

The Biden administration maintained most Trump-era tariffs. Some COVID-related medical products remained exempt under extensions of tariff exclusions, but broad relief was absent. Industry groups warned that tariffs acted like an excise tax, cutting into R&D budgets and raising hospital costs.

At the same time, new regulatory and competitive dynamics reshaped the market. The EU’s MDR introduced heavy compliance costs, leading many U.S. firms to deprioritize Europe as a launch market. In Asia, Singapore and South Korea positioned themselves as reliable, high-tech manufacturing bases. Singapore’s MedTech output rose to ~$14.5 Billion in 2022, while Korea launched a 2023–27 plan to double device exports.

The message for OEMs was clear: tariffs weren’t retreating, and companies needed new manufacturing anchors outside China.

2023–2025: De-Risking as Industrial Policy

By 2023, the narrative shifted from tariff battles to “supply chain resilience”. The U.S. CHIPS Act committed $280 billion to boost domestic semiconductor and related manufacturing. The EU followed with its own €43 billion Chips Act. China advanced the Made in China 2025 measures, targeting high-end medical devices and surgical robotics.

The manufacturing map became segmented:

- North America focused on high-value, strategic manufacturing, particularly robotics, advanced imaging, and biotechnology.

- Europe emphasized regulatory-driven innovation.

- In Asia, India and ASEAN remained cost-competitive hubs, absorbing much of the diversification away from China.

Tariffs remained in force, but the bigger story was realignment. Firms adopted China+1 sourcing across India, Vietnam, and Mexico. By 2025, Vietnam and India were among the largest sources of U.S. electronics imports, supported by low labor costs (with Indian manufacturing wages at approximately 4–5% of U.S. benchmarks) and policy incentives.

Prevailing Tariff Landscape in 2025

- US: The U.S. sharply increased tariffs on medical and tech imports in 2024–25. Under a September 2024 Section 301 action, duties on many China-made healthcare items surged — syringes/needles rose from 0% to 100%, while masks, respirators, and gloves moved from 25% to 50%. These 25–100% hikes, covering lab supplies and PPE, were aimed at reducing reliance on China.

In mid-2025, the U.S. extended this approach to India. President Trump added 25% on top of an existing 25% duty, raising tariffs on most Indian medical devices to 50%. - EU: EU tariffs were capped at 15% under a bilateral pact.

- China: Retaliated with ~34% duties on U.S. imports.

- India: In India, import duties continue to range between5–10% for most devices, but policies such as bans on refurbished imports reflect protectionist leanings.

The net effect: Higher landed costs, slower supply chains, and growing vendor-concentration risks for medical device companies.

With tariffs clearly following cyclical patterns, the key question for MedTech leaders is how to respond effectively. In the next part of this series, we break down practical frameworks and actionable strategies that enable MedTech companies to maintain cost competitiveness and supply assurance in dynamic trade environments.

Beyond Tariff Waves: Building Enduring MedTech Supply Chains – Part Two

Your Guide to Resilient Medtech Supply Chains