Post-COVID, in vitro diagnostic (IVD) has transitioned from episodic use to being integral across precision medicine, preventive care, and consumer health. The pandemic drove unprecedented demand, with the global IVD market surging by 45.4% in value from 2019 to 2020. Massive public and private investment scaled testing capacity and accelerated innovation. Health systems recognized that widespread rapid testing could save lives. IVD medical devices became routine and spurred a new wave of innovation and investment.

After the acute crisis, momentum continued, supported by government initiatives to strengthen healthcare diagnostics and a renewed appreciation for the value of diagnostic testing. As a consequence, the sector remains fast-expanding: the global in vitro diagnostics (IVD) market reached approximately USD 112 billion in 2024, growing at a CAGR of 6.9% from 2020 to 2024.

The strategic question for MedTech leaders of today is where to focus R&D and commercial efforts amid this growth wave. Should firms prioritize high-volume established markets or faster-growing regions like India and ASEAN? Which device segments offer the greatest potential for clinical and business impact? This article explores global market shifts, high-growth segments, and regional strategies likely to shape the next decade of IVD leadership.

The Global In Vitro Diagnostics Market Landscape

The IVD industry is led by a cadre of global MedTech pioneers with broad product portfolios spanning clinical chemistry to molecular testing. On the other hand, a long tail of specialized players and startups drives niche innovation. Growing price pressures in routine tests, fueled by competition and bulk purchasing, are pushing innovators to explore new growth areas, such as digital diagnostics, to supplement more commoditized segments.

Growth Drivers for the IVD Medical Device Industry

- Preventive healthcare and screening: Healthcare payers and providers are increasingly emphasizing early detection and prevention to improve outcomes and reduce costs. This is boosting demand for screening tests and routine health checks. For instance, many countries are expanding screening for colorectal cancer, cervical cancer, and infectious diseases, all requiring in vitro diagnostics.

- Precision medicine: The rise of targeted therapies has driven the demand for companion diagnostics. The FDA had approved roughly 60 companion diagnostics by 2024, many leveraging next-generation sequencing (NGS). As oncology drugs fragment into biomarker-driven niches, diagnostics become indispensable to treatment decisions and payer coverage.

- Decentralisation and consumerization: The pandemic challenged the lab’s monopoly on testing. Point-of-care (PoC) and at-home tests now serve routine monitoring, triage and remote care, unleashing large new markets.

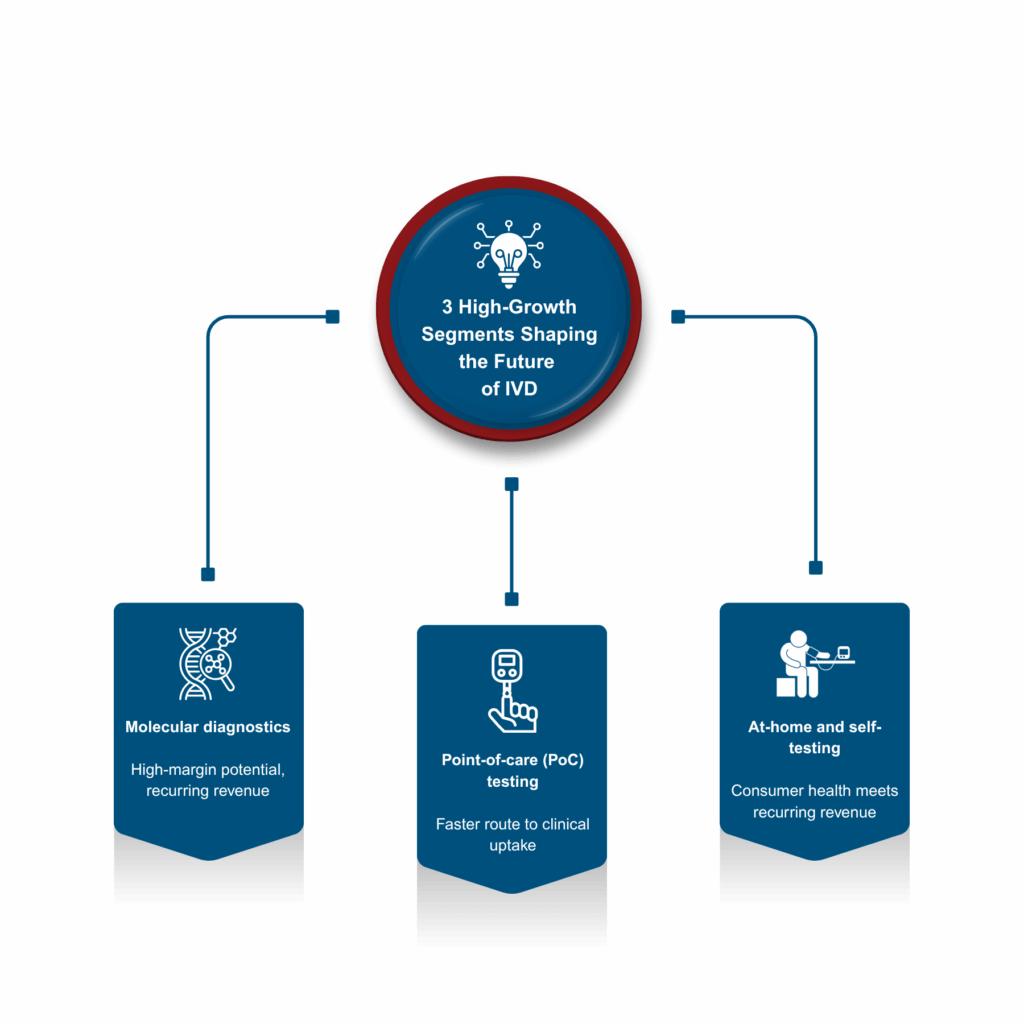

High-Growth Segments Shaping the Future of IVD

The evolution of in-vitro diagnostics will be defined by the effectiveness of innovation in addressing the twin pressures of healthcare systems: improving patient outcomes while containing costs. Three high-growth segments—molecular diagnostics, point-of-care testing, and at-home/self-testing—stand out because they meet urgent clinical demands for speed, accuracy, and accessibility. Simultaneously, they unlock new business opportunities by expanding testing beyond traditional labs and into decentralized, high-volume settings.

1. Molecular Diagnostics: High-Margin Potential and Recurring Revenue

Market Momentum: Molecular diagnostics has become the growth engine within IVD, with oncology and infectious disease driving both clinical pull and payer acceptance. The global cancer diagnostics market is projected to grow from USD 65.5 B in 2025 to USD 148.2 B by 2035, at a CAGR of 8.5%. Liquid biopsy is one of the fastest-growing segments within this market, driven by advances in detecting circulating tumor DNA/cells and the shift toward multi-gene NGS panels for comprehensive genomic profiling.

Commercial Drivers: Expanding payer coverage is reinforcing clinical adoption. In the U.S., Medicare’s 2018 coverage of certain NGS panels signalled reimbursement willingness, while a 2023 survey found ~89% of private payers interested in multi-cancer early detection (MCED) blood tests, with some running pilots.

Scale-up Challenges: Scaling molecular assays demands robust supply chains for specialized reagents and consumables, stringent contamination-controlled workflows, and rigorous clinical and analytical validation for regulatory approval. These factors raise time-to-market and development cost, making platform strategies and early regulatory planning essential.

Insights from a US Molecular Diagnostics Company’s Scale-Up

Problem:

In early 2020, the COVID-19 pandemic triggered unprecedented demand for molecular testing. As a consequence, a leading US-based molecular diagnostics company, faced the challenge of increasing cartridge production tenfold within weeks while global supply chains faltered and manufacturing operations were restricted due to lockdowns.

Solution:

Leveraging its extensive installed base, the company rapidly deployed a new assay cartridge across thousands of instruments in hospitals and labs, bypassing capital equipment barriers and immediately expanding testing capacity.

Approach:

- Applied lean manufacturing principles for 24/7 production

- Secured priority reagents via strategic supplier partnerships

- Activated automation to maintain quality at surge volumes

- Delivered millions of cartridges globally within months

Value Delivered:

- Enabled decentralized testing when lab capacity was constrained

- Expanded installed base to new healthcare settings

- Post-pandemic, adoption of additional assays drove >30% growth in non-COVID testing by 2023

Critical Takeaway: Platform extensibility transformed a crisis response into long-term recurring revenue

2. Point-of-care (PoC): Fastest Route to Clinical Uptake

Market Momentum: PoC testing brings in vitro diagnostics to the bedside, urgent care and community settings. The global point-of-care (PoC) diagnostics market is projected to grow from USD 44.1 billion in 2025 to USD 85.2 billion by 2035, at a CAGR of 6.8%. Infectious disease testing continues to be a significant driver, while chronic-disease monitoring and telehealth integration broaden other use cases.

Commercial Levers: The dominant commercial model is the reader + disposable cartridge (“razor and blades model”). Reusable readers house optics/electronics while single-use cartridges carry assay chemistry; new assays can be launched as cartridges against an existing installed base. This lowers per-test cost and shortens rollout cycles.

Manufacturing Considerations: PoC cartridge production needs micron-accurate plastic tooling, micro-injection molding (10–100 μm tolerances), cleanroom assembly, and automated inline QC. Machine vision and AI/ML inspection are often necessary to detect micro-defects in fluidic channels and optical elements.

3. At-home and Self-testing: Consumer Adoption Meets Recurring Revenue

Market Momentum: At-home diagnostics expanded from niche to mainstream during COVID-19 and continues to grow due to a rising chronic disease burden globally. The global self-testing market is projected to grow from USD 8.9 billion in 2025 to USD 16 billion by 2035, at a CAGR of 6.1%.

Commercial Levers:

- Bundling diagnostic tests with telehealth services transforms one-time transactions into ongoing patient relationships, improving retention and lifetime customer value.

- Insurance reimbursement can be transformational. For example, U.S. rules requiring insurers to cover up to eight at-home COVID tests per member per month (Jan 2022–May 2023) drastically expanded adoption.

- Retail and e-commerce channels drive a substantial share of at-home diagnostic test sales, with pharmacy chains alone contributing over 35% of total at-home testing revenue.

Design and Manufacturing Considerations: Home kits must be intuitive and reliable, with minimal steps, clear visuals, and durable packaging. Moreover, reagent formulations should remain stable for 12–24+ months across varied temperatures. Usability testing with regulatory validation must confirm that users can perform and interpret results accurately.

Market Assessment and Product Strategy: A Regional Framework for IVD Commercialization

United States: Mature In Vitro Diagnostics Market Driving Clinical Innovation

The U.S. is the world’s largest and most lucrative diagnostics market, accounting for ~43% of global IVD revenue in 2023. Favorable reimbursement frameworks from both public and private payers continue to drive adoption of tests with proven clinical utility.

Major players are investing in rapid, high-accuracy PoC molecular platforms that bridge laboratory precision with bedside convenience—ranging from compact near-PCR systems to FDA-authorized at-home molecular assays for respiratory infections. This underscores the market’s demand for clinically robust, consumer-ready solutions.

Europe: An In Vitro Diagnostics Landscape Favoring Validated Technologies

The EU’s new IVDR has raised clinical-evidence standards and extended approval timelines, reshaping regional market dynamics. These stringent requirements have created a premium for diagnostics demonstrating validated performance and regulatory resilience. Europe’s precision diagnostics market is projected to nearly double—from $23.3B in 2022 to $48.5B by 2028—driven by sustained demand for compliant, high-value tests.

Leading MedTech firms are investing in validation, automation, and IVDR readiness, expanding molecular and genomic profiling portfolios backed by favorable reimbursement for clinically proven assays.

India & Asia-Pacific: Emerging Hubs Powering Cost-Efficient In Vitro Diagnostics

India, China, and Southeast Asia represent the fastest-growing yet most price-sensitive diagnostics markets. India’s clinical diagnostics market is projected to expand at a CAGR of ~6% between 2025 and 2035. . Across Asia-Pacific, IVD markets are expected to grow ~6–7% annually as healthcare access expands. With lower per-capita healthcare budgets, cost-efficient, decentralized testing remains essential.

Governments are incentivizing local manufacturing through subsidy programs that promote domestic medical device production. Local success stories, such as battery-operated PCR platforms for infectious diseases and low-cost self-test kits with mass production capacity, highlight the importance of cost-optimized designs and supportive production incentives.

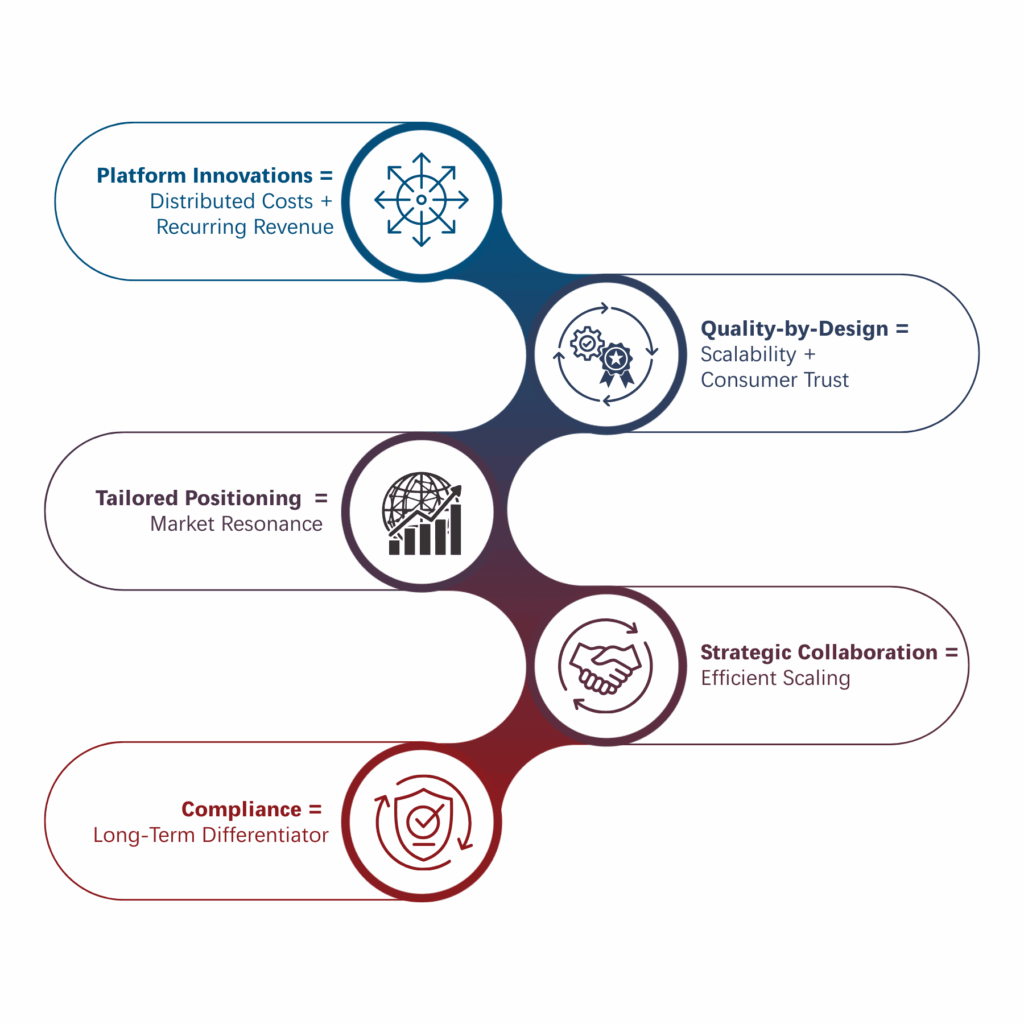

Accelerating Growth in IVD: Strategic Implications for MedTech Leaders

- Prioritize platforms over point products. Modular instruments and cartridge menus amortize IVDR/FDA evidence, de-risk launches and create recurring consumable revenue.

- Build scalability and quality-by-design. Precision reagents, contamination-controlled workflows and automated QC are not compliance checkboxes; they are revenue engines that retain customer and user trust.

- Design a multi-track GTM by region.

- US.: Prioritize advanced molecular and PoC assays with payer-backed value propositions, and engage early with FDA/CMS for streamlined coverage.

- Europe: Target precision diagnostics and companion tests, allocate adequate time/budget for IVDR conformity, and build robust health-economic cases to justify pricing.

- India/APAC: Design low-cost, decentralized products; localize manufacturing to compress landed costs and time-to-market.

- Leverage partnerships as strategic enablers. IVD manufacturing partners like Syrma Johari MedTech allow companies to scale production with cost efficiency while ensuring global compliance. Leveraging these partners helps companies build variable-cost structures and maintain agility amid demand volatility. On the other hand, collaborations with academic groups and startups can accelerate access to novel assays and digital interpretation tools.

- Treat quality and compliance as differentiators. Companies that invest early in ISO 13485, MDSAP, and regulatory pathways win market trust and minimize commercial friction. Compliance becomes a selling point because customers prefer suppliers who can demonstrate robust evidence packages and post-market surveillance.

Capturing the Next Wave of IVD Growth with Syrma Johari MedTech

Syrma Johari MedTech combines precision engineering, global quality, and scalable capacity to power the next generation of diagnostic innovation. Our ISO Class-8 cleanrooms, automated SMT lines, and advanced PCBA capabilities enable seamless integration of microfluidics, optics, and electronics. A rigorous design-for-manufacturing approach accelerates time-to-market and ensures reliability in high-throughput platforms.

Operating under ISO 13485:2016, US FDA QSR, and MDSAP frameworks, our audit-ready facilities uphold the highest global standards, simplifying regulatory approvals and market entry. With multi-site, scalable operations across India, we enable smooth transitions from pilot to full-scale production, ensuring agility, quality, and cost efficiency.

As IVD redefines precision medicine, near-patient testing, and preventive care, Syrma Johari MedTech empowers IVD innovators with quality-assured, tariff-resilient, and globally compliant production capabilities.